Bybit to Discontinue Services for Japanese Residents, Citing Regulations

- Bybit will begin phasing out services for Japan-based users starting in 2026

- Gradual account restrictions will be applied on a rolling basis

- Users incorrectly flagged as Japanese residents must complete extra identity checks

- Bybit is not registered with Japan’s Financial Services Agency (FSA)

- The exchange previously halted new user registrations in Japan

- Japan continues to enforce one of the world’s strictest crypto regulatory regimes

Crypto exchange Bybit announced it will begin discontinuing services for residents of Japan starting in 2026, introducing gradual account restrictions as part of its efforts to comply with the country’s regulatory framework.

According to the exchange, accounts identified as belonging to Japanese residents will face limitations on a rolling basis. Users who believe they were incorrectly classified have been asked to complete additional identity verification to confirm their residency status.

Bybit is not registered with Japan’s Financial Services Agency (FSA), which requires all crypto exchanges serving Japanese users to obtain local authorization. Without this approval, platforms face increasing pressure to limit or exit the market.

Bybit Confirms Regulatory Compliance Push

In its official statement, Bybit said Japanese residents should expect further communication as the remediation process progresses.

“If you're a resident of Japan, please note that starting from 2026 your account will be subject to gradual restrictions,” the exchange stated, adding that more updates will follow in future announcements.

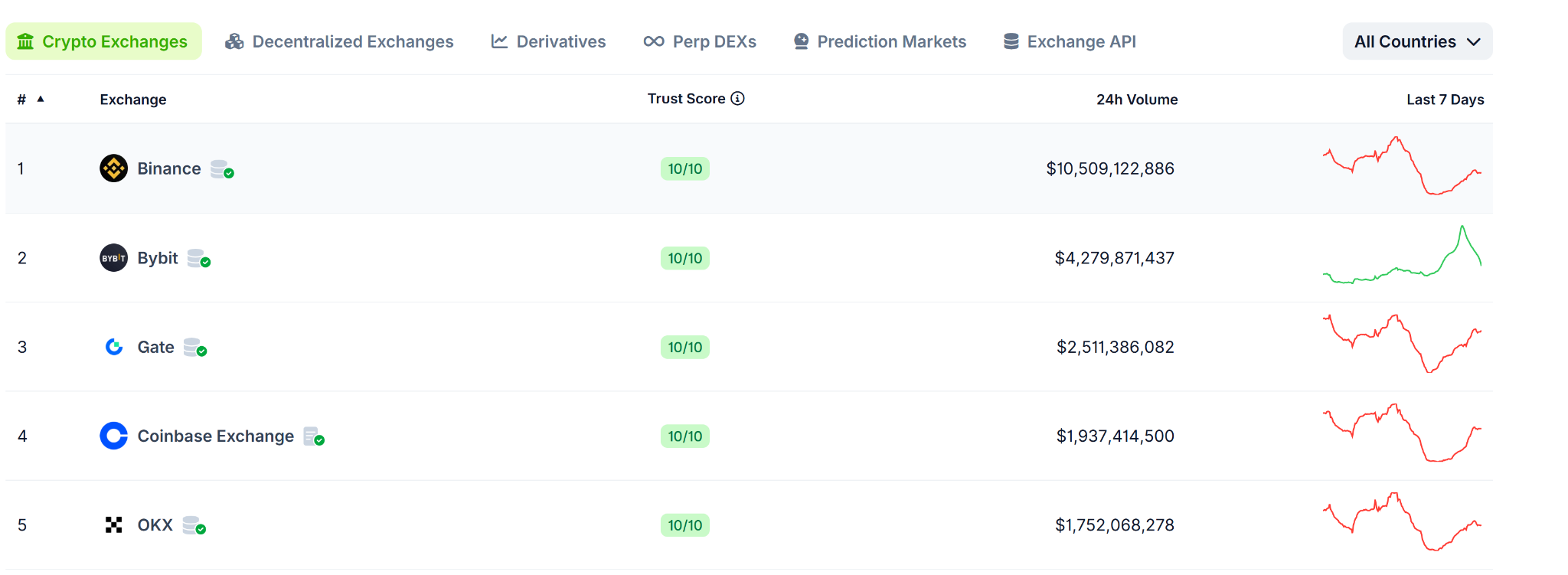

Despite the regulatory headwinds, Bybit remains one of the largest cryptocurrency exchanges globally. At the time of writing, it processed approximately $4.3 billion in trading volume over a 24-hour period, ranking among the top exchanges by volume according to CoinGecko.

Earlier Steps to Exit the Japanese Market

The latest announcement follows a series of moves by Bybit to reduce its exposure to Japan.

In October, the exchange paused new user registrations for Japan-based customers, citing ongoing discussions with the FSA. Regulatory pressure intensified further in February, when Japan’s regulator asked Apple and Google to remove five unregistered crypto exchanges from their app stores, including Bybit, KuCoin, Bitget, MEXC Global and LBank Exchange.

Japan is known for maintaining one of the strictest crypto oversight regimes globally. Industry leaders have warned that the country’s regulatory environment may be pushing crypto innovation offshore as compliance requirements continue to rise.

Contrasting Global Expansion Efforts

While scaling back in Japan, Bybit has continued expanding in other regions.

The exchange recently reentered the UK market after a two-year hiatus, launching a new platform offering spot trading and peer-to-peer services. The UK operations are conducted under a promotions arrangement approved by Archax, rather than through direct local registration.

Bybit has also strengthened its presence in the Middle East.

Last month, the company secured a Virtual Asset Platform Operator license from the United Arab Emirates’ Securities and Commodities Authority, following an earlier in-principle approval.